ev charger tax credit extension

This credit expired at the end of. Residential installation can receive a credit of up to 1000.

Commercial Ev Charging Incentives In 2022 Revision Energy

Plug-In Electric Vehicle Credit website and IRS Form 8936 which is available on the IRS Forms and Publications.

. In most cases that means all you have to do to qualify is install charging equipment on your businesss property and submit an application for credit. The EV Charging Station tax credit was extended at the end of 2019 for chargers installed from 2018-2020. Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access.

Can I claim the EV tax credit for my taxes if I pay for it or should. This included electric vehicle chargers. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

The credit amount will. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. This federal EV infrastructure tax credit will offset up to.

Congress has extended the alternative fuel infrastructure credit for tax years 2018-2021. This means that if your property installs SemaConnect EV charging stations between January 1. Where is the new form 8911.

Updated June 2022. Qualified Two-Wheeled Plug-In Electric Drive Motor Vehicle Tax Credit. Ad EV charging is good for the planet and good for business.

Charger Tax Credit as a Renter I am renting a house from a family member and would like to put in an EV charger for my cars. The amount of the credit will vary depending on the capacity of the. It covers 30 of the costs with a maximum 1000 credit for.

This allowed you to take a 30 credit on the cost of the charger on your taxes up to a 1000 limit. The federal tax credit was extended through December 31 2021. The tax credit now expires on December 31 2021.

The EV Charging Station tax credit was extended at the end of 2019 for chargers installed from 2018-2020. Co-authored by Stan Rose. Where To Find EV.

A federal tax credit of 30 of the cost of installing EV charging equipment which had expired December 31 2016 has been retroactively extended through December 31 2020. Where is the new form 8911. E-mobility is transforming transportation.

See what it can do for your business. Ad EV charging is good for the planet and good for business. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned.

The EV tax credit. The Federal 30C Tax Credit also referred to as the Alternative Fuel. The tax credit is retroactive and you can apply for.

Tax credits are available for EV charger hardware and installation costs. E-mobility is transforming transportation. Under the Biden administration there are high hopes that these EV charging tax credits will continue and even expand.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. See what it can do for your business. By Andrew Smith February 11 2022.

Federal Tax Credit Up To 7500. Tax Credit Amount 417 x Total Capacity kWh - 4kWh 2500 For the federal credit a manufacturer will have its credit value halved once 200000 electric vehicles are sold. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle.

It covers 30 of the costs with a maximum 1000 credit for. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. It is on the IRS site but not here.

Heat pumps EV chargers and these home improvements can net an average 500 in savings EPA expands Energy Star program Last Updated. If you install an EV charger for your electric car in your home you may want to take advantage of the federal tax credit. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial.

Install costs can account for the majority of the total cost of installing EV charging especially for. The US spending bill just agreed to last night includes extension of tax credits for home EV charger installations electric motorcycles and fuel-cell vehicles. Congress recently passed a retroactive federal tax credit including costs for EV charging infrastructure.

It is on the IRS site but not here. 5 2022 at 1039 am.

Solaredge Smart Ev Charger For Homeowners And Business Read

Amazon Com Megear Level 1 2 Ev Charger 100 240v 16a Portable Evse Home Electric Vehicle Charging Station Nema6 20 With Adapter For Nema5 15 Automotive

Best Ev Chargers For 2022 Tested Car And Driver

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

How To Claim An Electric Vehicle Tax Credit Enel X

Accell Axfast Dual Voltage Portable Electric Vehicle Charger Evse Level 2 P 120240v Usa 1 In 2022 Electric Car Charger Accell Evse

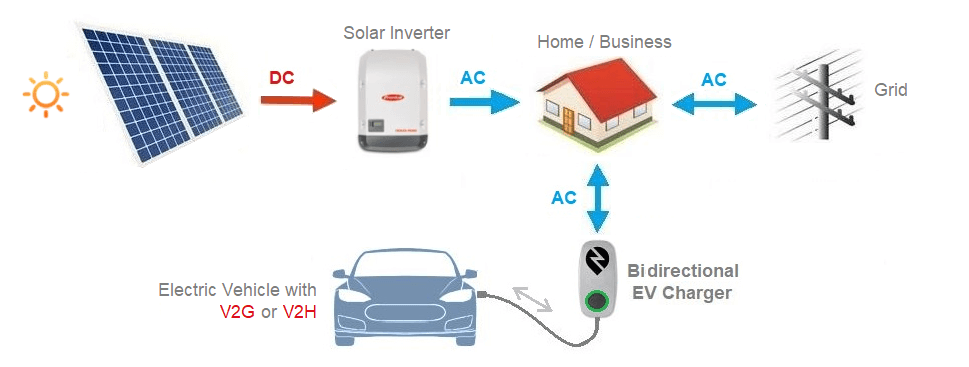

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

Tax Credit For Electric Vehicle Chargers Enel X

Rebates And Tax Credits For Electric Vehicle Charging Stations

What S In The White House Plan To Expand Electric Car Charging Network Npr

Amazon Com Vevor Level 2 Ev Charger 32 Amp 110 240v Portable Electric Vehicle Charger With 25 Ft J1772 Charging Cable Nema 14 50 Plug 10 16 20 24 32a Adjustable Plug In Ev Charging Station For Electric Cars Automotive

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

80a Level 2 Evse Cs 100 Hardwired Clippercreek

Buy Chargepoint Home Flex Chargepoint

Ev Charging Tacoma Public Utilities

Ev Charging Stations City Electric Supply

How To Choose The Right Ev Charger For You Forbes Wheels

Ev Charging What You Need To Know About Charging Your Electric Vehicle